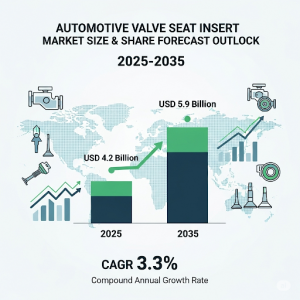

Automotive Valve Seat Insert Market to Hit USD 5.9 Billion by 2035 on Engine Durability & Material Innovation

Global market growth fueled by rising vehicle production, stricter emission norms, and advanced alloy development

NEWARK, DE, UNITED STATES, August 8, 2025 /EINPresswire.com/ -- The Automotive Valve Seat Insert Market is on a steady upward trajectory, projected to expand from USD 4.2 billion in 2025 to USD 5.9 billion by 2035, at a CAGR of 3.3%. This growth reflects a blend of surging vehicle production, evolving emission regulations, and an industry-wide shift toward advanced materials engineered for durability and performance.

Meeting the Industry’s Pressing Needs

Manufacturers across the automotive spectrum—from high-performance OEMs to cost-conscious rebuilders—are facing a convergence of challenges:

• Higher combustion temperatures in modern gasoline and hybrid engines

• Greater wear resistance demands from downsized and turbocharged units

• Regulatory pressure to lower emissions and improve fuel efficiency

Valve seat inserts, a small but crucial component within the cylinder head, now sit at the heart of these challenges. They must maintain sealing integrity under intense heat and pressure while supporting consistent combustion and fuel economy.

Steel Leads the Way

In 2025, steel will represent 39.7% of the market’s material share, solidifying its dominance due to its mechanical strength, thermal stability, and wear resistance. Engine manufacturers value steel for its ability to withstand extreme combustion conditions without deforming, aided by ongoing advances in alloying and heat treatment.

Steel’s cost-effectiveness and compatibility with varied engine geometries have kept it at the forefront, especially for high-volume passenger vehicle production. The material’s role will remain pivotal as manufacturers seek a balance between performance and affordability.

Passenger Vehicles: The Prime Consumer

With 46.8% market share in 2025, the passenger vehicle segment will continue to be the largest consumer of valve seat inserts. The high production volumes of cars worldwide, combined with the dominance of gasoline engines in this category, fuel steady demand.

As consumers expect greater performance and fuel efficiency, manufacturers are adopting lightweight designs and more durable materials, ensuring these components endure over longer lifespans with minimal maintenance.

Gasoline Engines Maintain Market Dominance

The gasoline engine segment, accounting for 42.1% of revenue in 2025, continues to anchor the market. Its global prevalence—especially in passenger cars and light commercial vehicles—means a constant requirement for inserts that can handle the stresses of high thermal loads and mechanical impact.

Innovations in turbocharging, direct injection, and downsizing have heightened the technical demands on valve seat inserts, pushing suppliers to refine material formulations and manufacturing precision.

Addressing the Complexity of Modern Powertrains

Developing valve seat inserts for diverse engine types—gasoline, diesel, natural gas, hybrid—requires balancing multiple performance factors:

• Thermal resistance for high-temperature cycles

• Wear tolerance under rapid valve operation

• Sealing accuracy to ensure clean combustion

The challenge is compounded by OEM certification requirements and the need to fit varying cylinder head materials and geometries. This creates longer development timelines, higher costs, and entry barriers for smaller suppliers.

Unlocking Opportunities in Commercial and Hybrid Engines

Heavy-duty trucks, buses, and agricultural machinery demand inserts that perform under sustained high load, while hybrid engines—often running hotter—require advanced heat-resistant solutions. Markets in Asia-Pacific, particularly China and India, are expanding rapidly, supported by rising production and aftermarket demand.

Suppliers offering tailored solutions for dual-fuel systems, high-mileage fleets, and hybrid platforms are well positioned to capture these growth segments.

Technology Trends Reshaping the Market

Material and process innovation is becoming the decisive edge:

• Nickel- and cobalt-based alloys for extreme thermal stability

• Ceramic composites for extended service life

• Powder metallurgy and sintering for microstructure precision

These advancements extend service intervals, lower maintenance costs, and help meet stricter emissions standards—making them attractive to OEMs seeking competitive differentiation.

Navigating Cost Pressures

Raw material price volatility—particularly in iron, nickel, cobalt, and ceramics—remains a persistent challenge. Premium materials offer performance gains but can be difficult to justify in price-sensitive markets unless they deliver measurable lifecycle benefits.

Smaller producers without long-term sourcing agreements are especially vulnerable, underscoring the need for strategic procurement and diversified material portfolios.

Country-Level Insights

• China leads with a 4.5% CAGR, fueled by high-volume passenger and light commercial vehicle production. OEMs favor alloy-based inserts for higher compression ratios, while engine rebuilders demand standardized, durable sizes.

• India follows at 4.1%, with strong demand from hatchback, utility, and two-wheeler segments. Inserts for LPG and CNG conversions are increasingly in demand.

• Germany posts 3.8% growth, driven by premium OEMs and performance engine builders, emphasizing low-porosity materials and advanced coatings.

• United Kingdom at 3.1% leverages legacy engine and motorsport applications, with rebuild markets favoring pre-sized, grind-ready formats.

• United States, growing at 2.8%, maintains demand through heavy-duty, off-road, and restoration segments, supported by robust aftermarket distribution.

Competitive Landscape

The market’s competitive field features both global leaders and specialized niche suppliers:

• MAHLE: Advanced alloys, regional manufacturing expansion

• Eaton: OEM-integrated solutions for hybrid and conventional engines

• Federal-Mogul (Tenneco): Powder metallurgy expertise and thermal coatings

• GKN Automotive: Precision forging and custom profiles

• Mitsubishi Materials: High-purity alloys for weight and fuel efficiency gains

• Nippon Piston Ring & TPR: Integrated piston-valve system compatibility

• Hutchinson & Goodson Tools & Supplies: Specialty and aftermarket-ready solutions

Outlook: Innovation Meets Regulation

As emission norms tighten and engine designs evolve, the automotive valve seat insert market will remain a critical enabler of performance and compliance. The next decade will reward manufacturers that combine material science expertise, precision machining, and supply chain resilience to meet the varied demands of OEMs, rebuilders, and performance specialists.

By aligning production capabilities with the needs of modern and future powertrains, suppliers can secure their place in a market where small components make a big difference in efficiency, reliability, and sustainability.

Request Automotive Valve Seat Insert Market Draft Report -

https://www.futuremarketinsights.com/reports/sample/rep-gb-22879

For more on their methodology and market coverage, visit

https://www.futuremarketinsights.com/about-us

Explore Related Insights

Automotive GNSS Chip Market:

https://www.futuremarketinsights.com/reports/automotive-gnss-chip-market

Automotive Interior Trim Parts Market:

https://www.futuremarketinsights.com/reports/automotive-interior-trim-parts-market

Automotive DC-DC Converter Market:

https://www.futuremarketinsights.com/reports/automotive-dc-dc-converter-market

Automotive Brake Shims Market:

https://www.futuremarketinsights.com/reports/automotive-brake-shims-market

Automotive Air Filters Market:

https://www.futuremarketinsights.com/reports/automotive-air-filters-market

Editor’s Note:

The Automotive Valve Seat Insert Market is poised for steady growth, fueled by rising vehicle production and stricter emission norms. Steel remains the leading material, with strong demand from high-growth regions such as China and India.

Rahul Singh

Future Market Insights Inc.

+1 347-918-3531

email us here

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.